Advanced security solutions for the digitally-led world

Financial crime has risen significantly as criminals take advantage of the digital-led economy. When coupled with heightened compliance for Anti-Money Laundering, sanctions obligations, and fraud detection, it creates myriad of challenges. Moreover, recent breaches across banking networks highlights the ever-increasing threat of payments crime and the particular vulnerabilities to SWIFT, Wire, Instant payments and Open Banking.

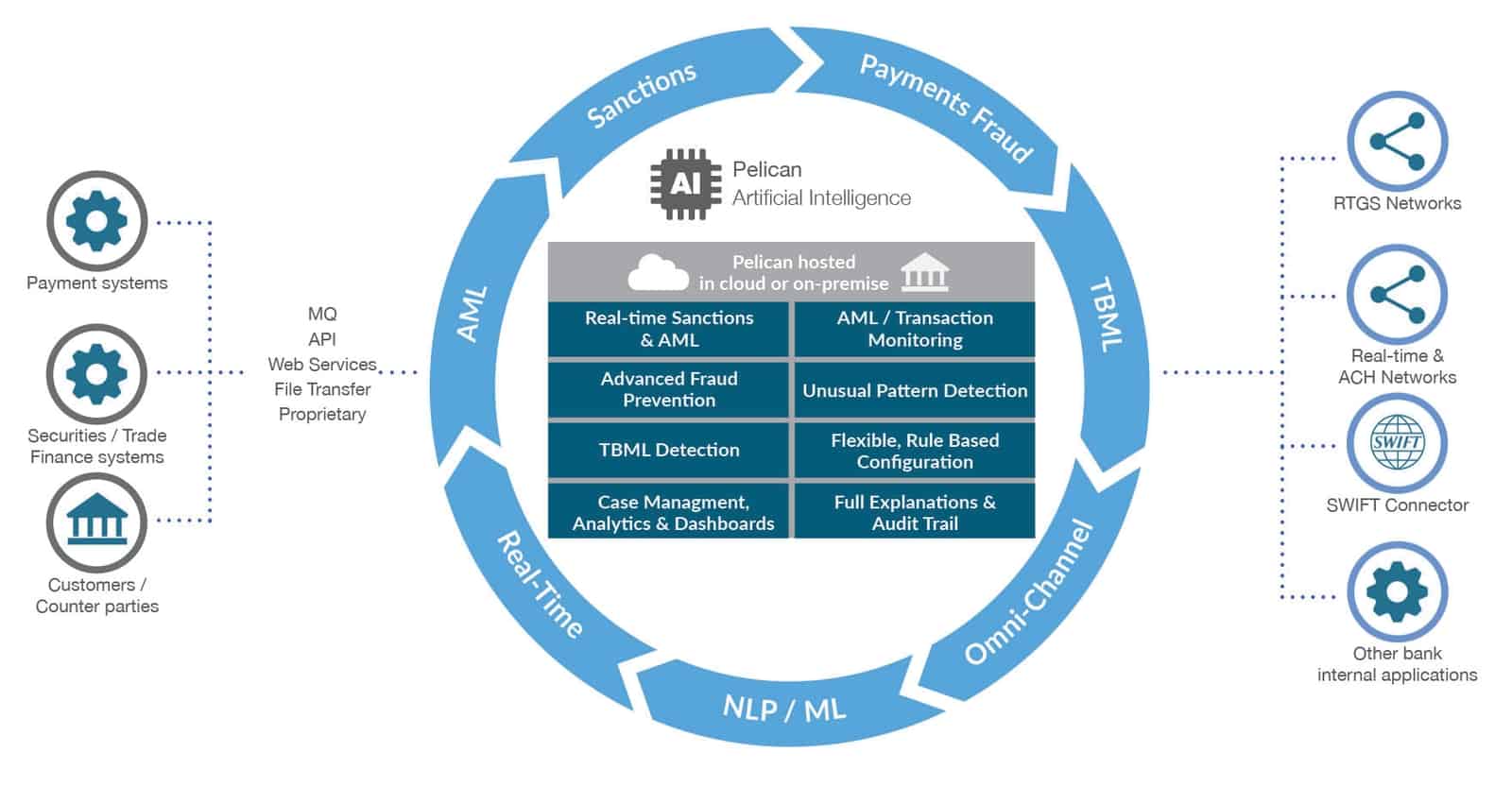

Pelican AI provides a comprehensive suite of AI-powered financial crime compliance solutions to address these challenges. Pelican Secure specifically addresses Financial Crime Compliance for payments and trade finance. It leverages AI and NLP to analyse patterns of behaviour to identify and flag subtle anomalies that are indicative of financial crime. This allows you to protect all stages of the payments and transaction lifecycle including; sanctions and other watchlists screening, trade-based money laundering, AML transaction monitoring and payments fraud prevention.

This is Pelican AI’s advanced financial crime compliance platform, backed by 25 years of AI and payments expertise. Purpose-built, completely secure, seamlessly integrated, and utterly essential.

80% improvement in investigation times

Enjoyed by Pelican clients using the AI-powered alerts dashboard.

70% reduction in operational costs

By a global bank after rolling out Pelican solutions.

75% reduction in false positives, reduce risk

With our fully integrated AI-powered payments and financial crime solution.

Enterprise Real-Time and Batch Screening

Watchlist and Sanctions Screening Compliance

Adhering to regulatory directives and updated watchlists across all business lines and territories can be burdensome and complex, with serious financial and reputational consequences. Rising false positive alerts adds to the challenge as it increases the cost of compliance and increases the risk of human error.

Leveraging the unique combination of Natural Language Processing (NLP), Machine Learning and Pelican's expert knowledge, Pelican Secure Screening allows you to detect sanctioned entities in real-time.

All while providing you with the highest levels of efficiencies and significantly reduced operating costs.

Key features

- Accurately screen against any standard or proprietary watchlist by using unique Natural Language Processing (NLP) technology

- Reduce review times by 80%, with detailed alerts and investigation dashboard

- Lower False Positive Rates (FPR) with its self-learning functionality

- Become format agnostic - we support any file format, or message type, including unstructured and free format text

Self Learning Optimisation

Reduce False Positives

Watchlist screening is becoming ever more complex, with false positive rates increasing for many institutions. The amount of false positive alerts adds to the increase of cost and increased risk of human error.

Pelican Secure integrates with your existing watchlist screening solutions to drastically reduce false positives, cutting compliance cost and delivering reputational protection across all payment processes and counterparties.

Key features:

- Capture, analyse and learn from user actions and payment attributes using Natural Language Processing (NLP) and Machine Learning technologies

- Full control by authorised users in configuring the engine logic, parameters or thresholds authorisations

- Detailed explanations for false positive alert reductions

- Full transparency and audit trail for every action taken

- Fine tune alerts with an extensive knowledge base library of rule-like understanding models

- High throughput and low latency to assure high performance

- Ongoing supervised learning on how alerts are resolved

AML Transaction Monitoring

Monitor AML transactions across the payments life-cycle

Failure to comply with Anti-Money Laundering (AML) legislation can have serious financial and reputational consequences for your organisation. The need to rapidly adhere to updated AML compliance and reporting obligations can be burdensome and complex.

Pelican Secure is able to meet rapidly evolving global AML challenges. It can support all your offline (end of day) as well as real-time AML obligations.

Key features

- Detect pattern anomaly of money laundering activity in offline and real-time modes using Machine Learning and NLP

- Flag suspicious transactions before they leave the door

- Advanced analytics and reporting enabling efficient alert management

- Easily integrate with existing systems through our modular AML solution

- Rich omni-channel user-interface with mobile and tablet support

Secure Trade Digitisation, Automation, and Compliance

Trade compliance managed in one AI-based solution

Following a regulatory tightening of compliance checks on payment systems and processes, Trade Finance is now under increased regulatory focus. There are multiple stringent new guidelines in force, including from Singapore’s MAS, Hong Kong’s HKMA and the UK’s FCA.

Pelican Secure’s trade solution addresses the growing challenge of trade screening and trade based money laundering - securing global trade, managing risks and protecting your reputation.

Key features

- Extract relevant information from all documents with the highest degree of accuracy using OCR technology for trade paper digitisation

- Understand all trade instruments and messages (including free format) using the AI discipline of Natural Language Processing (NLP)

- Perform consistency checks on key information across multiple trade documents in different formats

- Effectively manage trade compliance, covering enhanced sanctions and dual-use goods filtering as well as TBML red flags checks

Real-Time Fraud Prevention

AI Powered Fraud Detection

Effective fraud protection requires solutions that do not merely respond to past patterns of attack, but ones that deploy highly advanced predictive and anomaly aware technology – detecting and preventing new fraudulent payment patterns in real-time.

Pelican Secure’s fraud prevention solution uses Machine Learning Artificial Intelligence technology to analyse patterns of behaviour to identify and flag subtle anomalies that are indicative of fraud.

Key features

- Analyse patterns of behaviour to identify fraud using Machine Learning

- Keep steps ahead of fraudsters with Machine Learning that enables you to understand its pattern analysis

- Improve efficiency with significantly reduced false positives

- A comprehensive hybrid approach, with Rule Engine, Supervised learning and Unsupervised learning.

- High throughput/low latency solutions provider certified to support real-time schemes.

Pelican Secure Solutions

Find Out More

Built for simplicity and scalability, you can integrate Pelican in as little as four weeks. Reach out and our global team will help you find the right solution for your business.

Related resources & information

Video: Trade-based Money Laundering

Learn More >Article: How AI can address the increasing complexity of false positives in sanctions screening

Learn More >Article: Making better use of technology in the fight against financial crime

Learn More >Totally Integrated. Uniquely Powerful.

Pelican AI’s solutions leverage the unique capabilities of the Pelican Platform.

Each of Pelican's award-winning payments and compliance solutions leverages the advanced capabilities and technologies of the Pelican Platform. These include the Artificial Intelligence disciplines of Machine Learning, Natural Language Processing and Voice processing; Open API integration; rich Omni-Channel UX; flexible Cloud deployment scenarios; and real-time capabilities.

Collectively they provide a uniquely rich technology core, powering the most advanced and capable payments and compliance solutions.